Understanding the Snowball Method for Debt Repayment

The snowball method is a pragmatic debt repayment strategy aimed at progressively eliminating individual debts and enhancing financial stability. This approach focuses on paying off the smallest debts first while ensuring that minimum payments are maintained on the larger ones. By simplifying the debt repayment process, it provides actionable steps towards financial freedom.

How the Snowball Method Works

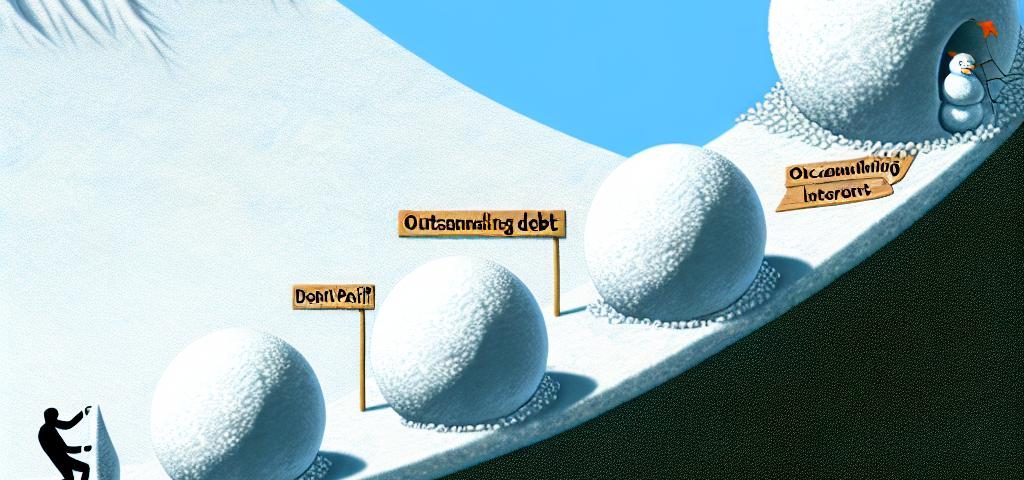

At its core, the snowball method involves arranging all your debts from the smallest to the largest balance. This systematic approach encourages making minimum payments on all debts, except the smallest one. The idea is to direct any extra funds toward paying the smallest debt. Once this debt is fully cleared, you use the funds once allocated to it for the next one on the list, creating a “snowball” effect where your capacity to pay off debts increases as you clear each one.

Steps to Implement the Snowball Method

Implementing the snowball method involves a structured approach:

1. List Your Debts: Begin by cataloging all your current debts, organizing them from the smallest balance to the largest. Focus on the total debt amount and the outstanding balance, while interest rates remain a secondary focus.

2. Make Minimum Payments: Ensure that you pay the minimum amount required for each debt monthly. This maintains your good standing with creditors and prevents any additional fees or penalties.

3. Target the Smallest Debt: Allocate any extra funds available each month towards paying off the smallest debt as promptly as possible. This could be money saved from budgeting or any additional income.

4. Move to the Next Debt: Once the smallest debt is settled, shift your strategy to the next smallest debt. Combine the amount you previously used to pay off the initial debt with any extra funds, applying this to the next debt target.

Benefits of the Snowball Method

The snowball method offers several benefits that appeal to individuals who wish to regain control over their financial obligations:

Motivation Through Quick Wins: By focusing on the smallest debts first, quick wins are achieved, boosting motivation. This can make the process less daunting and more rewarding as you see tangible progress.

Disciplined Financial Habits: As debts are methodically paid off, habits of budgeting and financial discipline are cultivated, potentially leading to more sustainable financial management in the future.

Reduction in Number of Debts: This method effectively reduces the number of outstanding debts faster than other methods. For those overwhelmed by managing multiple monthly payments, this can be a significant relief.

Potential Drawbacks to Consider

Despite its motivating factors, the snowball method is not without drawbacks:

Potential Higher Costs: By not focusing on interest rates, there is a possibility of paying more in interest over the lifespan of your debts. For individuals seeking to minimize interest payments, this could be less than ideal.

Numerical Inefficiency: While the method is psychologically effective, those prioritizing financial efficiency might favor the debt avalanche method, which targets high-interest debts first.

Is the Snowball Method Right for You?

Determining if the snowball method is appropriate for you involves an assessment of personal priorities and financial goals:

Psychological Boosters: If you are someone who thrives on short-term achievements and gains confidence from crossing off debts, the snowball method could align with your motivational needs.

Simple Structure: For individuals seeking a straightforward and less complex approach to debt repayment, this method offers a clear path without the complication of intricate calculations.

Financial Assessment: It is critical to evaluate your current financial situation thoroughly. Consider whether your priority is reducing the overall amount paid or achieving quick psychological wins. If your primary goal is minimizing interest payments, consider strategies that factor interest rates more prominently.

In conclusion, the snowball method offers a structured and motivational approach to managing and repaying debts. It highlights the importance of aligning one’s debt repayment strategy with personal goals and financial circumstances. By doing so, individuals can pursue a path that not only reduces debt but also builds financial confidence and discipline.